Polyethylene Furanoate (PEF) Technical Textile Fiber Market Outlook 2026–2036: Growth Driven by Barrier Performance

PEF technical textile fibers gain traction as buyers prioritize barrier efficiency, durability, and repeatable scale in performance-led textiles.

NEWARK, DE, UNITED STATES, January 23, 2026 /EINPresswire.com/ -- Market Overview: PEF Fibers Move from Validation to Scalable Adoption

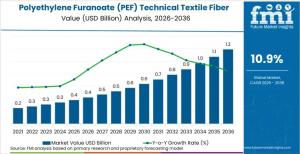

The Polyethylene Furanoate (PEF) Technical Textile Fiber Market is entering a structured growth phase as technical textile buyers shift toward specification-led procurement. Valued at USD 0.4 billion in 2026, the market is projected to reach USD 1.2 billion by 2036, expanding at a CAGR of 10.9%. Growth is anchored in applications where barrier-linked performance, dimensional stability, and durability can be consistently demonstrated without disrupting large-scale textile conversion.

Key Market Signals

- Market value expected to triple between 2026 and 2036

- Growth driven by performance retention rather than sustainability positioning alone

- Adoption concentrated in industrial and technical textile programs

Request For Sample Report | Customize Report | Purchase Full Report –

https://www.futuremarketinsights.com/reports/sample/rep-gb-31749

Procurement Shift: Why Performance Repeatability is Now the Deciding Factor

Technical textile procurement frameworks are evolving toward long-run operational stability. Buyers are evaluating fibers based on their behavior across spinning, fabric formation, finishing, and real-world stress exposure. PEF fibers are gaining acceptance where they deliver predictable outcomes across repeated production campaigns, reducing revalidation costs and production risk.

What Buyers Are Prioritizing

- Consistent spinning and downstream processing behavior

- Stable oxygen and moisture barrier performance

- Minimal variability across batches and production sites

Functional Advantage: Barrier Performance as a Commercial Catalyst

PEF fiber adoption is advancing where barrier functionality translates directly into product-level performance gains. Improvements in permeability control, dimensional stability, and durability reduce end-use failures, particularly in industrial textiles and long-life interior applications. These gains are most valuable where performance loss over time has direct cost implications.

Performance Drivers

- Enhanced oxygen and moisture barrier behavior

- Improved durability under repeated mechanical stress

- Reduced dependence on heavy coatings or multilayer constructions

Product Analysis: Filament Yarns Lead Commercial Scale-Up

Filament yarns dominate the PEF technical textile fiber market, accounting for 44.0% of demand. Their uniform tensile behavior and dimensional control support high-speed manufacturing while protecting downstream performance specifications. Staple fibers are expanding selectively in interior and blended textile applications where bulk and handfeel are required alongside durability.

Product Insights

- Filament yarns preferred for consistency and process control

- Staple fibers gaining traction in interiors and blended structures

- Niche formats remain limited to early-stage programs

Application Focus: Industrial Textiles Anchor Demand

Technical and industrial textiles represent 42.0% of total demand, making them the primary growth engine for PEF fibers. These applications reward materials that maintain performance over extended service life and under harsh conditions. Home and interior textiles are emerging as a secondary growth area, while performance apparel adoption remains selective due to finishing and dyeing consistency requirements.

Leading Applications

- Technical and industrial textiles

- Durable home and interior textiles

- Select performance apparel constructions

End-User Dynamics: Early-Adopter Brands Drive Initial Volumes

Early-adopter brands account for 33.3% of market demand as they validate PEF fibers for differentiated performance positioning. These buyers typically scale volumes after consistent results are demonstrated across multiple production runs. High-throughput textile producers follow once conversion stability is proven.

End-User Trends

- Controlled initial adoption followed by portfolio expansion

- Emphasis on documentation and repeatability

- Preference for suppliers with technical support capability

Geographic Outlook: Asia and North America Lead Growth

China and the United States are the fastest-growing markets, expanding at CAGRs of 12.4% and 12.0% respectively. China benefits from its ability to industrialize new polymer pathways at scale, while U.S. growth is driven by specification-led procurement in industrial textiles. Europe and advanced Asian economies show steady, quality-driven adoption.

High-Growth Countries

- China

- United States

- United Kingdom

- Germany

- South Korea and Japan

Competitive Landscape: Scale Discipline Defines Market Leadership

Competition in the PEF technical textile fiber market centers on supply reliability, narrow quality windows, and responsive technical support. Buyers increasingly favor suppliers that can support qualification with structured documentation and stable batch performance. Long-term share gains are expected to favor companies with secure upstream furan chemistry inputs and multi-site delivery capability.

Key Players

- ALPLA

- Resilux

- Mitsubishi Chemical Group

- Toray Industries

- Avantium

- Indorama Ventures

- Teijin

- Far Eastern New Century

- Yibin Grace New Materials

- Synvina

Market Outlook: Where the Most Reliable Opportunities Will Emerge

Through 2036, the strongest opportunities will arise in industrial and durable textile applications where PEF’s barrier and stability advantages align directly with performance targets. As upstream furan chemistry supply becomes more predictable, fiber producers will be better positioned to secure long-term contracts and expand multi-factory adoption.

Related Reports

Aircraft Topcoats Market – https://www.futuremarketinsights.com/reports/aircraft-topcoats-market

Electronics Adhesives Market – https://www.futuremarketinsights.com/reports/electronics-adhesives

market

Dolomite Market – https://www.futuremarketinsights.com/reports/dolomite-market

Have a specific Requirements and Need Assistant on Report Pricing or Limited Budget please contact us - sales@futuremarketinsights.com

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

Contact Us:

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware - 19713, USA

T: +1-347-918-3531

Why FMI: https://www.futuremarketinsights.com/why-fmi

For Sales Enquiries: sales@futuremarketinsights.com

Website: https://www.futuremarketinsights.com

LinkedIn| Twitter| Blogs | YouTube

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.