Shufti Finds Key Verification Challenges in Emerging Markets, Helping Global Businesses Cut False Rejections and Costs

Global businesses risk losing customers and revenue due to ID and address verification failures in Vietnam, Brazil, and Mexico, Shufti finds.

LONDON, UNITED KINGDOM, January 16, 2026 /EINPresswire.com/ -- Shufti, a global provider of identity verification and compliance technology, has released new insights into the factors driving verification failures in Vietnam, Brazil, and Mexico, highlighting how document complexity, local address reforms, and national ID variations can impact onboarding and compliance for businesses worldwide.

Many global companies across crypto, forex, iGaming, and social platforms have reported persistent pass rate issues with previous providers in these markets. According to Shufti’s findings, these challenges are largely due to inherent document complexities, including multi-part names, heavy use of diacritics, and inconsistent structures, rather than fraudulent behaviour.

Key Challenges and Verification Impact in Emerging Markets

Shufti’s findings highlight that in Vietnam, businesses are experiencing widespread address verification failures due to administrative reforms implemented in July 2025. The country restructured its national address hierarchy and reorganised provincial and local units, but millions of identity documents and proof-of-address records still reflect the old system.

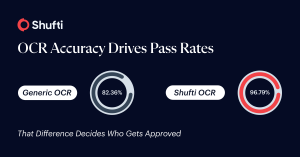

Verification systems that cannot interpret both formats frequently map valid addresses incorrectly, leading to failed residency checks, delayed onboarding, and increased manual review costs. Additionally, Vietnam’s naming conventions, often multi-part and using diacritics, cause generic verification tools to misread or reorder characters, further increasing errors and operational friction. Shufti’s in-house OCR engine achieves approximately 96.79% accuracy, compared to 82.36% with generic providers, reducing false rejections and operational friction.

In Brazil, verification failures stem from the diversity and quality of documents. Many IDs are paper-based, faded, or printed with overlapping fields, while inconsistent labels make automated extraction unreliable. The CPF number, critical for linking addresses and identities to government records, is frequently misread. Mis-extracted CPFs trigger failed downstream checks, generating unnecessary database requests, raising operational costs, and increasing the likelihood of customer rejection. Shufti ensures CPF extraction accuracy of 98.85% and applies checksum validation, minimizing errors, unnecessary verification attempts, and costs.

Mexico presents yet another challenge. More than fifty official ID formats are actively used, many featuring holographic overlays or complex security graphics that obscure essential fields. Combined with the two-surname naming convention, this often leads to misassigned names and corrupted address data. The result: failed residency checks, AML mismatches, and slower onboarding, directly impacting customer acquisition and operational efficiency.

Shufti’s context-aware OCR and layout-aware extraction handle these complexities, improving accuracy, reducing manual interventions, and accelerating user onboarding.

“Address and identity verification fails at the data layer before any fraud is detected,” said Shahid Hanif, CEO of Shufti. “Businesses operating internationally face unnecessary compliance risk and higher costs if verification systems can’t interpret local documents accurately. Our technology ensures local data structures, document formats, and naming conventions are interpreted correctly, enabling global platforms to reduce false rejections and onboard users efficiently and compliantly.”

To reduce mismatch-driven failures within address verification workflows, Shufti outlined address-verification controls applied in these markets:

-Support for both legacy and current address formats to prevent errors in jurisdictions affected by administrative reforms.

-Diacritic- and multi-part name–aware OCR to minimise mismatches between document data and user input.

-Layout-aware extraction for diverse ID designs with overlapping or inconsistent labels.

-CPF checksum validation in Brazil to ensure accuracy before downstream database checks.

These measures help businesses worldwide:

-Reduce false rejections and accelerate onboarding.

-Lower operational costs by minimising manual reviews and unnecessary database requests.

-Maintain compliance with AML, KYC, and global privacy regulations.

-Expand operations across multiple jurisdictions with confidence.

Shufti’s research highlights an urgent trend: as companies scale globally, identity and address verification failures in emerging markets are a significant operational and financial risk. Organisations relying on generic verification solutions risk losing revenue, higher costs, and friction in customer acquisition.

These findings are intended to help compliance and operations teams proactively understand market-specific verification challenges and implement solutions that safeguard growth, efficiency, and customer trust.

To learn more about the Shufti address verification report, visit here: https://shuftipro.com/blog/why-kyc-fails-in-vietnam-and-how-to-fix-it/

About Shufti

Shufti is a global identity verification and digital trust platform, trusted by over 1,000 clients across fintech, payments, crypto, gaming, and other regulated digital ecosystems. It enables real-time, risk-based identity and address verification, helping businesses verify users efficiently, reduce fraud, and protect privacy.

Its proprietary architecture unites biometric liveness detection, multilingual OCR for 10,000+ IDs, and global address verification that adapts to local formats, along with device and behavioural intelligence and reusable identity tokens. These capabilities help businesses reduce fraud, meet compliance obligations, and accelerate onboarding without compromising privacy.

SOURCE SHUFTI

Neliswa Mncube

Shufti

+44 1225 290329

email us here

Visit us on social media:

LinkedIn

Bluesky

Instagram

Facebook

YouTube

TikTok

X

The Uncertainty Principle in KYC

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.