Alexander Clifford Announces New Initiatives to Enhance R&D Tax Credit Support for UK Businesses

LONDON, UNITED KINGDOM, December 19, 2025 /EINPresswire.com/ -- Alexander Clifford, an R&D tax credit claims specialist, has announced a suite of new initiatives designed to strengthen support for innovative businesses across the UK. The programme focuses on improving claim accuracy, reinforcing HMRC compliance, and enhancing the overall experience for companies seeking to access government-backed R&D tax relief.

The new initiatives reflect the firm’s commitment to delivering a more transparent, technically robust, and audit-ready approach to R&D tax credit claims, particularly as HMRC continues to increase scrutiny across the sector.

Strengthening Technical Accuracy and Compliance

Under the enhanced framework, Alexander Clifford has introduced more rigorous technical assessments, improved documentation standards, and advanced claim validation processes. These developments are intended to ensure that each submission meets the expectations outlined in HMRC’s post-merge R&D tax relief regime.

Businesses can learn more about the company’s R&D tax credit services here: R&D Tax Credit Specialists

Helping UK Businesses Navigate Changing HMRC Rules

With recent reforms reshaping how R&D tax relief operates in the UK, many SMEs now face uncertainty regarding eligibility, claim requirements, and compliance obligations. Alexander Clifford’s new initiatives include:

1) A refined discovery process to identify qualifying R&D activities with greater precision

2) Enhanced cost-analysis modelling to support accurate calculation of eligible expenditure

3) Updated narrative and evidence frameworks aligned with HMRC’s current audit standards

4) Proactive communication and education for clients to help them adapt to policy changes

More information about compliant R&D claims is available at: Claim r&d tax credits

Supporting UK Innovation Through Improved Guidance

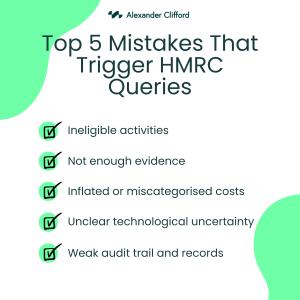

As part of its commitment to raising standards in the industry, Alexander Clifford will also release new educational resources designed to improve transparency and prevent common errors that can lead to HMRC enquiries. These resources will focus on the correct interpretation of qualifying activities, the role of technological uncertainty, and best practices for preparing audit-ready supporting documents.

A Forward-Looking Approach to R&D Tax Relief

The introduction of these initiatives reinforces Alexander Clifford’s position as a compliance-led, results-driven specialist in R&D tax credits. By investing in improved technical processes, clearer documentation frameworks, and client education, the firm aims to provide UK innovators with the confidence and support needed to maximise their entitlement under the R&D tax relief scheme.

About Alexander Clifford

Alexander Clifford is an R&D tax credit specialist based in the United Kingdom, dedicated to helping businesses across the UK maximise their innovation funding. With a reputation built on deep technical knowledge, a rigorous compliance-led approach, and a no win, no fee guarantee, the firm has helped thousands of companies recover millions in tax relief across sectors including IT, Manufacturing, Medtech, and Engineering.

For more information about Alexander Clifford and its services, please visit our website at Alexanderclifford.co.uk

Media Contact:

Managing Director: Andrew Dean

Email: hello@alexanderclifford.co.uk

Phone: 0161 457 8100

Website: alexanderclifford.co.uk

The new initiatives reflect the firm’s commitment to delivering a more transparent, technically robust, and audit-ready approach to R&D tax credit claims, particularly as HMRC continues to increase scrutiny across the sector.

Strengthening Technical Accuracy and Compliance

Under the enhanced framework, Alexander Clifford has introduced more rigorous technical assessments, improved documentation standards, and advanced claim validation processes. These developments are intended to ensure that each submission meets the expectations outlined in HMRC’s post-merge R&D tax relief regime.

Businesses can learn more about the company’s R&D tax credit services here: R&D Tax Credit Specialists

Helping UK Businesses Navigate Changing HMRC Rules

With recent reforms reshaping how R&D tax relief operates in the UK, many SMEs now face uncertainty regarding eligibility, claim requirements, and compliance obligations. Alexander Clifford’s new initiatives include:

1) A refined discovery process to identify qualifying R&D activities with greater precision

2) Enhanced cost-analysis modelling to support accurate calculation of eligible expenditure

3) Updated narrative and evidence frameworks aligned with HMRC’s current audit standards

4) Proactive communication and education for clients to help them adapt to policy changes

More information about compliant R&D claims is available at: Claim r&d tax credits

Supporting UK Innovation Through Improved Guidance

As part of its commitment to raising standards in the industry, Alexander Clifford will also release new educational resources designed to improve transparency and prevent common errors that can lead to HMRC enquiries. These resources will focus on the correct interpretation of qualifying activities, the role of technological uncertainty, and best practices for preparing audit-ready supporting documents.

A Forward-Looking Approach to R&D Tax Relief

The introduction of these initiatives reinforces Alexander Clifford’s position as a compliance-led, results-driven specialist in R&D tax credits. By investing in improved technical processes, clearer documentation frameworks, and client education, the firm aims to provide UK innovators with the confidence and support needed to maximise their entitlement under the R&D tax relief scheme.

About Alexander Clifford

Alexander Clifford is an R&D tax credit specialist based in the United Kingdom, dedicated to helping businesses across the UK maximise their innovation funding. With a reputation built on deep technical knowledge, a rigorous compliance-led approach, and a no win, no fee guarantee, the firm has helped thousands of companies recover millions in tax relief across sectors including IT, Manufacturing, Medtech, and Engineering.

For more information about Alexander Clifford and its services, please visit our website at Alexanderclifford.co.uk

Media Contact:

Managing Director: Andrew Dean

Email: hello@alexanderclifford.co.uk

Phone: 0161 457 8100

Website: alexanderclifford.co.uk

Andrew Dean

Alexander Clifford

+44 161 457 8100

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.