Crypto Exchange Market In 2029

The Business Research Company's Crypto Exchange Market 2025 – Market Size, Trends, And Global Forecast 2025-2034

LONDON, GREATER LONDON, UNITED KINGDOM, December 11, 2025 /EINPresswire.com/ -- "Crypto Exchange Market to Surpass $72 billion in 2029. Within the broader Financial Services industry, which is expected to be $47,553 billion by 2029, the Crypto Exchange market is estimated to account for nearly 0.2% of the total market value.

Which Will Be the Biggest Region in the Crypto Exchange Market in 2029

North America will be the largest region in the crypto exchange market in 2029, valued at $28,844 million. The market is expected to grow from $9,953 million in 2024 at a compound annual growth rate (CAGR) of 24%. The exponential growth is supported by the increasing use of smartphones and the high number of internet users.

Which Will Be The Largest Country In The Global Crypto Exchange Market In 2029?

The USA will be the largest country in the crypto exchange market in 2029, valued at $26,282 million. The market is expected to grow from $9,024 million in 2024 at a compound annual growth rate (CAGR) of 24%. The exponential growth can be attributed to the increasing internet penetration and increasing e-commerce.

Request a free sample of Crypto Exchange Market Report

https://www.thebusinessresearchcompany.com/sample_request?id=21024&type=smp

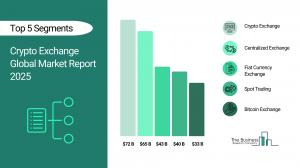

What will be Largest Segment in the Crypto Exchange Market in 2029?

The crypto exchange market is segmented by exchange model into centralized exchange and decentralized exchange. The centralized exchange market will be the largest segment of the crypto exchange market segmented by exchange model, accounting for 90% or $64,573 million of the total in 2029. The centralized exchange market will be supported by increasing cryptocurrency adoption, liquidity and volume and user experience.

The crypto exchange market is segmented by trading type into spot trading and derivatives trading. The spot trading market will be the largest segment of the crypto exchange market segmented by trading type, accounting for 56% or $40,126 million of the total in 2029. The spot trading market will be supported by increased adoption and volatility, rise in retail participation, integration with DeFi and NFTs (Non-Fungible Tokens), liquidity and market depth, spot trading pairs, mobile and user-friendly platforms.

The crypto exchange market is segmented by coin or token into bitcoin exchange, ethereum exchange, and altcoin exchange. The bitcoin exchange market will be the largest segment of the crypto exchange market segmented by coin or token, accounting for 46% or $33,271 million of the total in 2029. The bitcoin exchange market will be supported by bitcoin’s market dominance, institutional adoption and growing demand for secure and user-friendly trading platforms.

The crypto exchange market is segmented by payment method into fiat currency exchange and cryptocurrency exchange. The fiat currency exchange market will be the largest segment of the crypto exchange market segmented by payment method, accounting for 59% or $42,643 million of the total in 2029. The fiat currency exchange market will be supported by consumer demand for cryptocurrency access, bitcoin and cryptocurrency as an investment asset, economic uncertainty and inflation hedge, growth of the DeFi ecosystem, regulatory support and legalization, support for multiple fiat currencies.

What is the expected CAGR for the Crypto Exchange Market leading up to 2029?

The expected CAGR for the crypto exchange market leading up to 2029 is 24%.

What Will Be The Growth Driving Factors In The Global Crypto Exchange Market In The Forecast Period?

The rapid growth of the global crypto exchange market leading up to 2029 will be driven by the following key factors that are expected to reshape capital markets, digital asset trading, and global financial infrastructure worldwide.

Strong Economic Growth In Emerging Markets - The strong economic growth in emerging markets will become a key driver of growth in the crypto exchange market by 2029. Many emerging markets have populations with limited access to traditional banking services. Crypto exchanges present a viable alternative, allowing individuals to access digital financial services without requiring a bank account. As economic conditions improve, increasing numbers of people in these regions are gaining access to the internet and smartphones, facilitating greater participation in crypto trading.

Rise In Digital Payments Adoption - The rise in digital payments adoption will emerge as a major factor driving the expansion of the crypto exchange market by 2029. As digital payment methods such as mobile wallets, online banking, and e-commerce platforms become increasingly mainstream, consumers are more inclined to consider cryptocurrencies as an alternative or complementary payment option. The growing familiarity with digital transactions helps reduce the barriers to entry for potential crypto users.

Favorable Government Initiatives - The favorable government initiatives within digital manufacturing processes will serve as a key growth catalyst for the crypto exchange market by 2029. Governments that establish clear and supportive regulations for cryptocurrencies and exchanges play a crucial role in mitigating market uncertainty. Defined guidelines on taxation, anti-money laundering (AML), and know-your-customer (KYC) protocols simplify legal operations for exchanges. This reduces the risk of regulatory interventions and helps build confidence among investors, traders, and businesses.

Increasing Population And Urbanization - The increasing population and urbanization will become a significant driver contributing to the growth of the crypto exchange market by 2029. As the global population continues to grow, an increasing number of individuals are turning to alternative financial services, particularly in regions with limited traditional banking infrastructure. Crypto exchanges offer access to decentralized financial systems, attracting those who are unbanked or underbanked. Urban centres generally experience higher rates of technological adoption, with residents more inclined to explore digital currencies due to their tech-savvy nature. These areas also tend to have more advanced financial ecosystems, which can facilitate smoother integration of crypto services.

Increasing E-Commerce - The increasing e-commerce will serve as a key growth catalyst for the crypto exchange market by 2029. As e-commerce continues to expand, many businesses are diversifying their payment options to include cryptocurrencies such as Bitcoin, Ethereum, and others. This shift is driven by the growing adoption of digital currencies for online transactions. As more e-commerce companies integrate crypto payments, the demand for exchanges that facilitate the buying, selling, and trading of these digital assets is expected to increase.

Access the detailed Crypto Exchange Market report here:

https://www.thebusinessresearchcompany.com/report/crypto-exchange-market

What Are The Key Growth Opportunities In The Crypto Exchange Market in 2029?

The most significant growth opportunities are anticipated in the centralized crypto exchange market, the spot trading crypto exchange market, the bitcoin crypto exchange market, and the fiat currency crypto exchange market. Collectively, these segments are projected to contribute over $117 billion in market value by 2029, driven by increasing global cryptocurrency adoption, enhanced regulatory clarity across major economies, and technological innovations improving trading efficiency and liquidity. This surge reflects the rapid expansion of institutional participation, rising retail investor engagement, and the integration of advanced security and compliance frameworks, fuelling transformative growth within the broader crypto exchange industry.

The centralized crypto exchange market is projected to grow by $42,103 million, the fiat currency crypto exchange market by $27,857 million, the spot trading crypto exchange market by $25,555 million, the bitcoin crypto exchange market by $21,793 million over the next five years from 2024 to 2029.

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. We have published over 17,500 reports across 27 industries and 60+ geographies. Our research is powered by 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

We provide continuous and custom research services, offering a range of specialized packages tailored to your needs, including Market Entry Research Package, Competitor Tracking Package, Supplier & Distributor Package and much more.

Disclaimer: Please note that the findings, conclusions and recommendations that TBRC Business Research Pvt Ltd delivers are based on information gathered in good faith from both primary and secondary sources, whose accuracy we are not always in a position to guarantee. As such TBRC Business Research Pvt Ltd can accept no liability whatever for actions taken based on any information that may subsequently prove to be incorrect. Analysis and findings included in TBRC reports and presentations are our estimates, opinions and are not intended as statements of fact or investment guidance.

Contact Us:

The Business Research Company

Americas +1 310-496-7795

Europe +44 7882 955267

Asia & Others +44 7882 955267 & +91 8897263534

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company"

Oliver Guirdham

The Business Research Company

+44 7882 955267

info@tbrc.info

Visit us on social media:

LinkedIn

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.